Course HackSecuring Investment Returns in the Long RunBy University of Geneva, Rajna Gibson Brandon, Michel Girardin, Olivier Scaillet

In a Nutshell

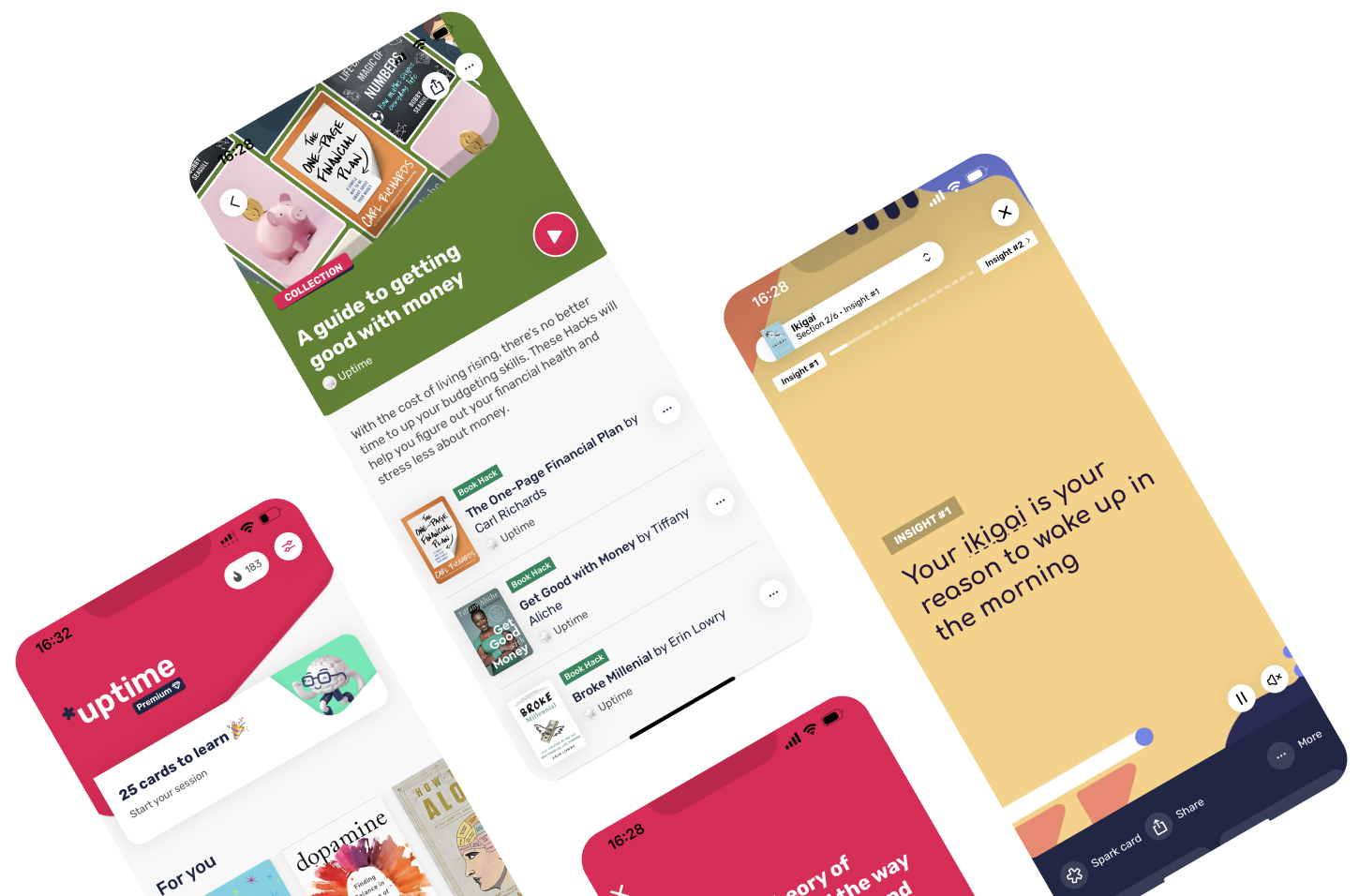

In this course, get to grips with one of the most widely used tools in investment, the investment fund, and discover the latest trends in finance.

Favorite Quote

I'd rather buy actively managed funds. I like the idea that possibly I have a Warren Buffet in my portfolio.

Michel Girardin

Introduction

An investment fund is a pool of money managed by a third party, who decides where the money gets invested.

Investment funds' utility lies in their time efficiency. They also require less expertise than picking assets yourself — someone else does it for you.

But the world of investment funds is confusing and full of jargon.

Michel Girardin, Rajna Gibson Brandon, and Olivier Scaillet are academics at the Geneva Finance Research Institute, University of Geneva. Alongside their colleagues and experts from UBS bank, they lead this Coursera course on investment funds.

The course explains active and passive investment funds and their relative merits, as well as how to judge their performance.

Students also get an overview of topics like the latest trends in finance, including sustainable investing and neurofinance.

Here are the 3 key insights from this Hack

- 1.The two key types of funds are active and passive funds

- 2.Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nunc volutpat, leo ut.

- 3.Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nunc volutpat, leo ut.